Adaptive Engulfing RSI Strategy

Adaptive Engulfing RSI Strategy

Adaptive Engulfing RSI Strategy

Adaptive Engulfing RSI Strategy - Estrategia de Velas Envolventes y RSI para MT4, MT5, NinjaTrader y cTrader

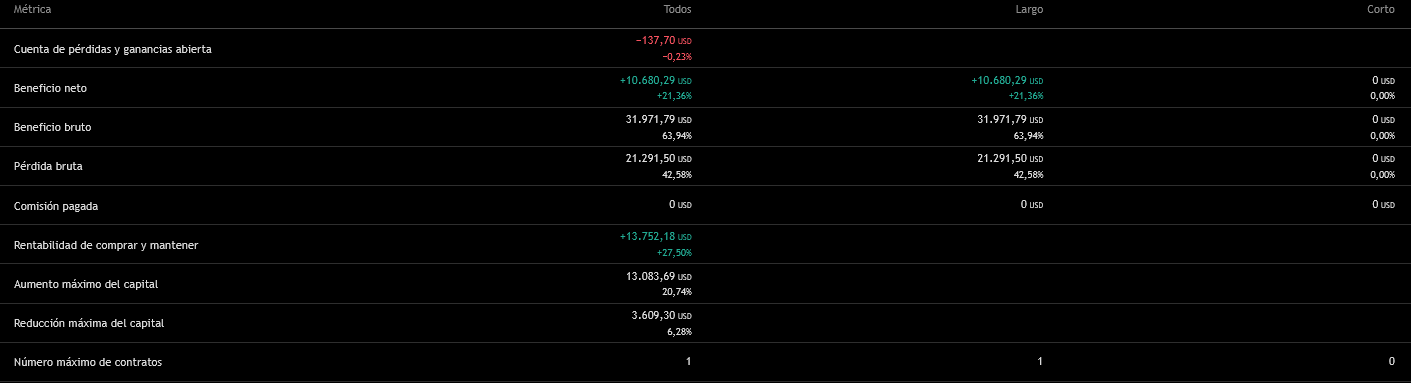

La Adaptive Engulfing RSI Strategy es una estrategia de trading automatizada que combina patrones de velas japonesas (envolventes alcistas y bajistas) con confirmaciones del indicador RSI y un sistema adaptativo de gestión del riesgo. El algoritmo identifica formaciones de velas envolventes, las filtra con un umbral configurable de RSI y valida la entrada con un Índice de Estabilidad de Velas para minimizar falsas señales. El stop loss dinámico se ajusta automáticamente al precio de entrada o al mínimo/máximo de un periodo definido, adaptándose mejor a distintos escenarios de mercado.

Las entradas largas se generan cuando aparece una vela envolvente alcista confirmada por el RSI y señales de debilidad en el corto plazo. Por el contrario, las salidas o posiciones cortas se activan ante patrones envolventes bajistas en zonas de sobrecompra del RSI y señales de agotamiento del precio. El sistema muestra etiquetas visuales de COMPRA, VENTA y STOP LOSS directamente en el gráfico, con colores y estilos personalizables, ofreciendo una lectura clara y rápida para la toma de decisiones.

Ideal para: Traders que operan con acción del precio y patrones de velas, pero buscan confirmaciones adicionales mediante indicadores técnicos como el RSI. Especialmente útil en forex, criptomonedas, índices y materias primas, donde la volatilidad exige precisión en entradas y salidas. Compatible con MT4, MT5, NinjaTrader y cTrader.

Acceso de por vida a todas las estrategias

Con tu primera suscripción obtienes acceso permanente a todas nuestras estrategias algorítmicas. Una vez activada, tendrás acceso de por vida sin costos adicionales.

Beneficios del acceso permanente

- Acceso permanente a todas las estrategias

- Nuevas estrategias incluidas automáticamente

- Sin pagos adicionales por estrategias

- Acceso incluso si cancelas la suscripción

¿Listo para revolucionar tu Trading?

Adquiere esta estrategia individualmente con acceso vitalicio en un unico pago. O suscribete y accede a todas nuestras estrategias con acceso permanente en tu primera suscripción.