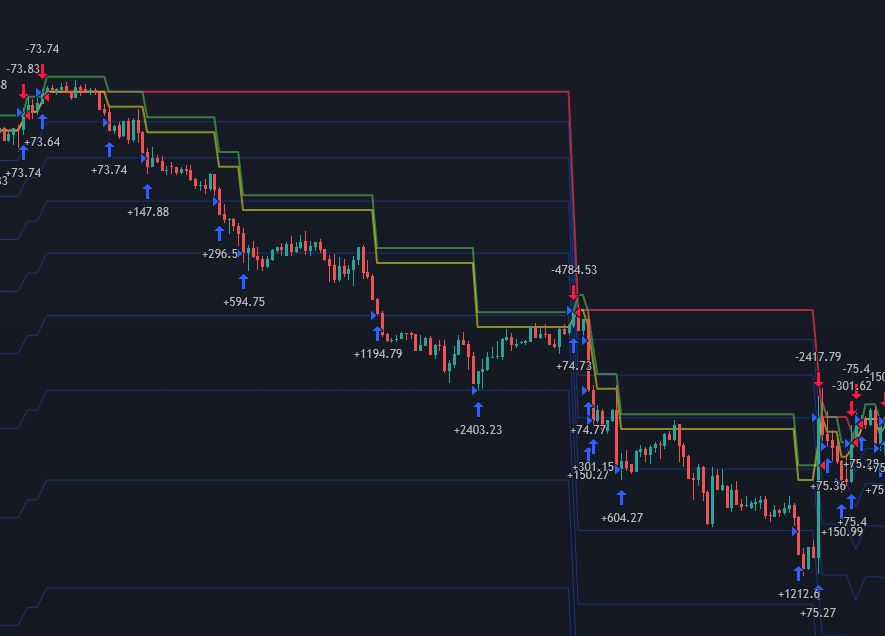

DCA Strategy

Dollar Cost Averaging Optimizado

Estrategia automatizada de Dollar-Cost Averaging (DCA) diseñada para optimizar la entrada en mercado mediante órdenes base y órdenes de seguridad escalonadas. Integra gestión avanzada de capital, escalado progresivo de volumen y control dinámico de desviación de precios para promediar el coste de entrada. Incluye configuraciones flexibles de take profit, hasta 50 niveles de órdenes, y visualización en gráfico de precios promedio y niveles de seguridad. Ideal para entornos de alta volatilidad, permitiendo suavizar drawdowns y asegurar beneficios consistentes con gestión de riesgo controlada.

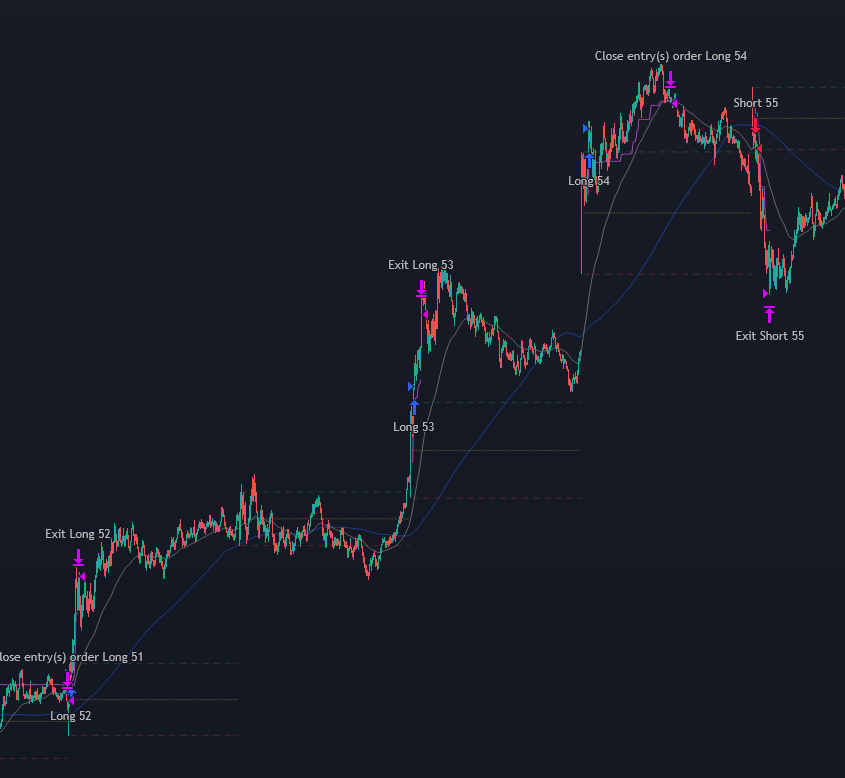

ORB Strike

Opening range breakout strategy

Estrategia de Opening Range Breakout que detecta automáticamente los movimientos más significativos del mercado durante las primeras horas de trading. Incorpora filtros de volumen, momentum y volatilidad para confirmar señales con alta precisión y gestión de riesgo automatizada.

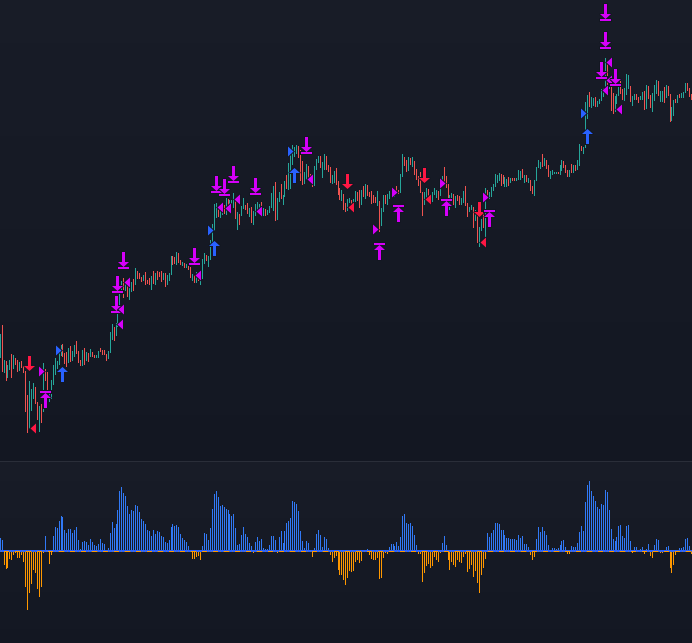

AI Volume-KNN SuperTrend

Adaptive AI Trading Strategy

Estrategia avanzada que combina un SuperTrend ponderado por volumen con un clasificador KNN para validar la dirección de la tendencia. Genera entradas cuando ambos coinciden (alcista o bajista) y salidas mediante trailing stop dinámico basado en ATR. Ofrece marcadores de inicio/continuación, colores adaptados a la tendencia y parámetros configurables de IA para mejorar precisión en mercados volátiles.

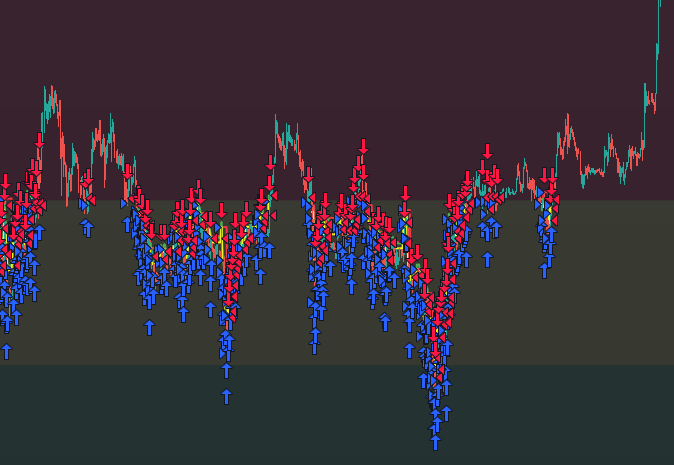

Bull-Bear Power ZScore

Statistical Momentum & Adaptive TP Strategy

Estrategia que combina Bull-Bear Power con un disparador estadístico basado en Z-Score y un sistema de take profit adaptable mediante ATR, ajustado por volumen y percentiles. Genera entradas cuando el Z-Score supera umbrales clave, salidas al cruzar la línea cero y permite take profits escalonados que se ajustan dinámicamente al contexto del mercado. Diseñada para adaptarse a distintas condiciones de volatilidad y volumen, buscando optimizar precisión y consistencia en los resultados.

Gaussian Trend Rider

Clean Trend-Following with Gaussian Smoothing

Estrategia seguidora de tendencia basada en una gaussiana simulada mediante doble SMA. Entra en largo cuando el precio está por encima de la línea de tendencia y sale al romperla por debajo. Incorpora una nube tipo cascada basada en ATR que aporta una visualización clara de la volatilidad, junto con marcadores de entrada/salida y colores dinámicos para resaltar la dirección. Diseñada para ofrecer simplicidad visual y eficacia en la detección de tendencias sostenidas.

Dual-BB SuperTrend

Enhanced Trend Signals Using Dual Bollinger Bands and SuperTrend

Estrategia que combina Bandas de Bollinger cortas y largas en un oscilador “BBTrend”, sobre el cual se aplica un SuperTrend para generar entradas y salidas. Ofrece filtros de dirección (long/short), etiquetas contrarias opcionales, y gestión de riesgo con TP/SL por porcentaje. La visualización usa columnas, brillos y etiquetas BUY/SELL para destacar cambios de tendencia. Diseñada para capturar giros tempranos y aprovechar impulsos con claridad visual.

Flex-ATR SuperTrend

Flexible Trend-Following with Custom ATR

Estrategia SuperTrend flexible diseñada para adaptarse a distintos métodos de ATR (estándar o SMA(TR)) y ventanas de fechas personalizadas para backtesting. Opera principalmente en largo, visualizando cambios de tendencia con un tema cian/magenta, incluyendo una nube resaltadora opcional y etiquetas BUY/SELL. Permite gestión de riesgo mediante TP/SL porcentuales, y su diseño enfatiza claridad visual y control sobre el período de operación.

AI KNN-Dual SuperTrend MTF

Dual Multi-Timeframe SuperTrend with KNN AI Filters

Esta estrategia combina doble SuperTrend en marcos de tiempo superiores (HTF) con dos clasificadores KNN, un filtro ADX/DMI y un sesgo por percentiles de pivote. Las entradas se ejecutan solo si hay consenso multi-capa entre los dos SuperTrend y los dos KNN, reforzado por el filtro ADX/DMI opcional y la fuerza del sesgo de percentiles.

Zone-Based DCA Long/Short

Grid-style DCA bot with zone filter and RSI entries

Bot DCA estilo grid para operar en Long o Short, usando órdenes base y de seguridad escalables, con entradas inmediatas o basadas en RSI y un filtro de zonas que limita la primera operación a niveles de precio definidos (L1–L5). Permite hasta 50 órdenes de seguridad con tamaño y distancia ajustables, Take Profit calculado sobre la orden base o el volumen total, y visualización directa en el gráfico de precios de apertura, promedio, TP y niveles de seguridad. Incluye tabla de control con presupuesto, beneficio, flotante, patrimonio y uso máximo de capital, además de poder configurar fechas de inicio y fin de operaciones, ofreciendo así una gestión completa y visual de tus estrategias DCA.

Adaptive Engulfing RSI Strategy

Trend entries with engulfing patterns, RSI filter, and adaptive stop loss

Estrategia Adaptive Engulfing RSI que combina patrones envolventes, filtro RSI y un índice de estabilidad de velas para detectar entradas más seguras, con stop loss adaptativo, gestión de posición en porcentaje o cantidad fija, y un filtro anti-ruido que evita señales repetidas. Permite personalizar colores, etiquetas y estilos visuales, mostrando claramente en el gráfico las señales de compra, venta y stop loss, con alertas visuales grandes y llamativas. Esta estrategia ofrece un enfoque técnico y visual completo para optimizar entradas y salidas, mejorar la claridad de las operaciones y proteger el capital de forma dinámica según la acción del precio.