Zone-Based DCA Long-Short

Zone-Based DCA Long-Short

Zone-Based DCA Long-Short

Zone-Based DCA Long-Short - Estrategia Automatizada para MT4, MT5, NinjaTrader y cTrader

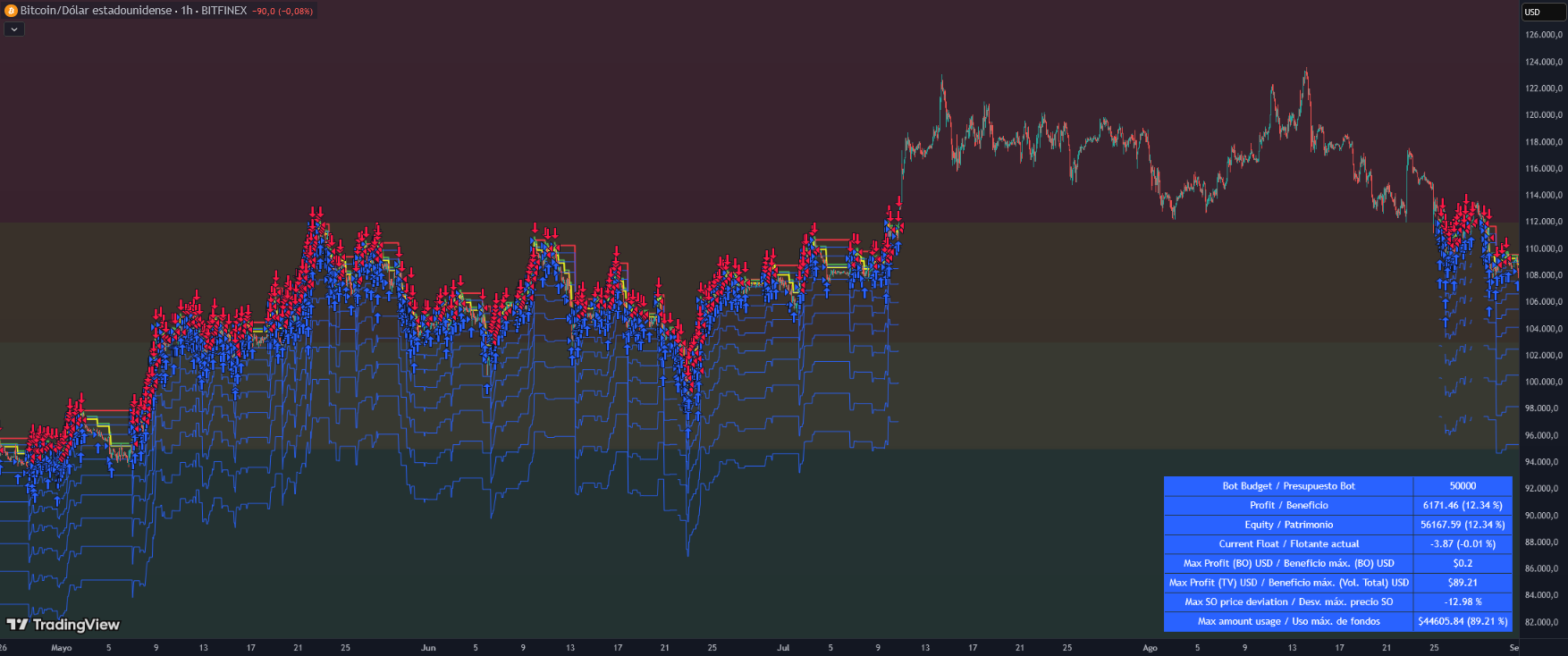

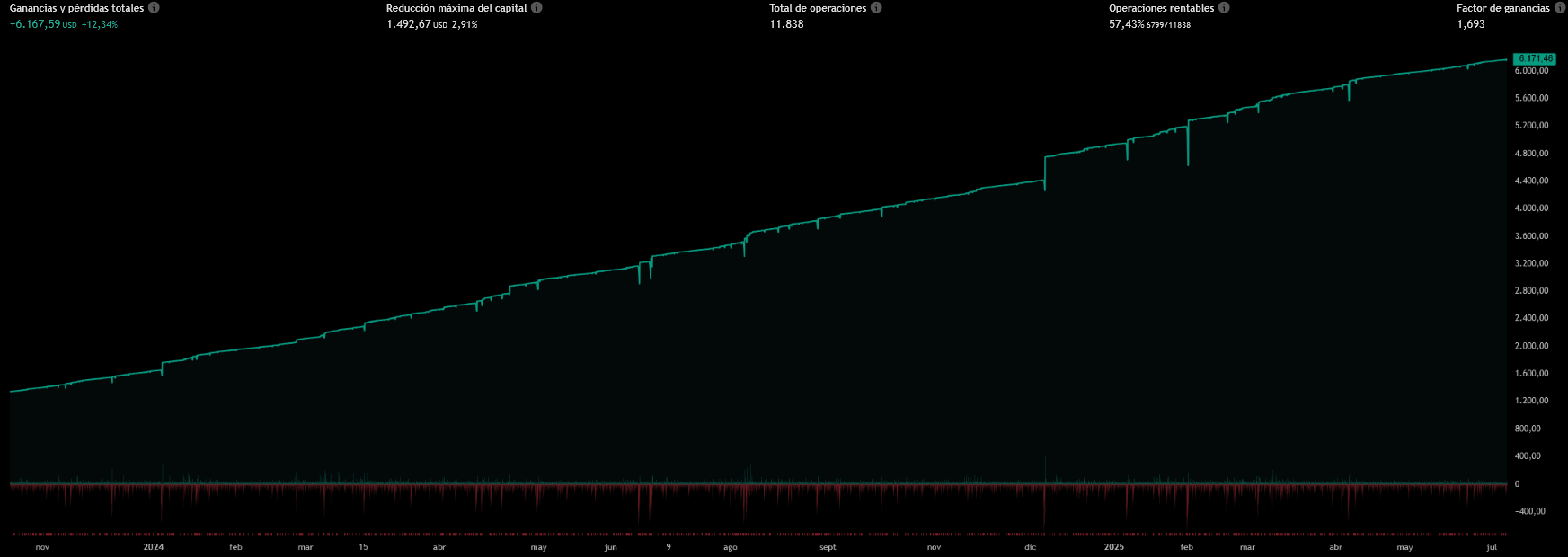

Zone-Based DCA Long-Short es una estrategia avanzada de Dollar-Cost Averaging (DCA) que automatiza tanto posiciones largas (Long) como cortas (Short). Su lógica se basa en un sistema de grid inteligente que coloca una orden inicial y escala progresivamente con órdenes de seguridad configurables. Los objetivos de beneficio se calculan dinámicamente en función de la orden base o del volumen total, maximizando la eficiencia en cada operación.

El sistema permite mayor personalización gracias a filtros adicionales: activación inmediata o validada por RSI, configuración de fechas de inicio y fin, y un potente filtro por zonas que restringe las operaciones a áreas de precio definidas manualmente. Esto otorga al trader control total sobre cuándo y dónde operar, optimizando la gestión del riesgo en mercados de alta volatilidad.

El take profit es totalmente dinámico, cancelando automáticamente las órdenes de seguridad pendientes una vez alcanzado el objetivo. Además, la estrategia incluye una tabla de estadísticas en tiempo real dentro del gráfico, mostrando datos clave como presupuesto del bot, beneficio acumulado, equity, flotante, desviación máxima y uso estimado de capital.

Ideal para: Traders que buscan una estrategia DCA flexible y automatizada, con soporte para largos y cortos, control avanzado de zonas de operación y gestión dinámica del capital. Es especialmente eficaz en mercados volátiles como forex, criptomonedas, índices y materias primas, donde suavizar entradas y gestionar el riesgo de manera precisa es fundamental. Compatible con MT4, MT5, NinjaTrader y cTrader.

Acceso de por vida a todas las estrategias

Con tu primera suscripción obtienes acceso permanente a todas nuestras estrategias algorítmicas. Una vez activada, tendrás acceso de por vida sin costos adicionales.

Beneficios del acceso permanente

- Acceso permanente a todas las estrategias

- Nuevas estrategias incluidas automáticamente

- Sin pagos adicionales por estrategias

- Acceso incluso si cancelas la suscripción

¿Listo para revolucionar tu Trading?

Adquiere esta estrategia individualmente con acceso vitalicio en un unico pago. O suscribete y accede a todas nuestras estrategias con acceso permanente en tu primera suscripción.